A new briefing by Just Share finds that over half of the Top 40 JSE-listed companies do not have, on their boards, a single director with a formal sustainability-related qualification, and that only 25 of the 487 director positions in the Top 40 (5%), are held by directors with a sustainability-related qualification.

Non-financial risks and opportunities, including those related to inequality, climate change, environmental harms, biodiversity impacts and artificial intelligence are becoming increasingly more relevant considerations in corporate governance. To ensure that risks are properly understood and managed, and that opportunities are maximised, company boards must fully integrate sustainability considerations into company operations, planning and resource allocation.

Board-level sustainability expertise (i.e., relevant knowledge obtained via formal qualifications, skills and experience) is essential to this endeavour, and requires that companies ensure that their boards are appropriately capacitated. The lack of such expertise on Top 40 company boards raises concerns about these companies’ ability to fully integrate crucial sustainability considerations into their strategies and decision-making.

In most corporate governance contexts, the knowledge associated with expertise is closely correlated with a suitable formal qualification. A business degree is generally regarded as necessary to having business expertise, financial expertise is associated with having a chartered accountancy or finance-related degree, and a law degree is associated with legal expertise. There is no reason why sustainability expertise should be approached any differently.

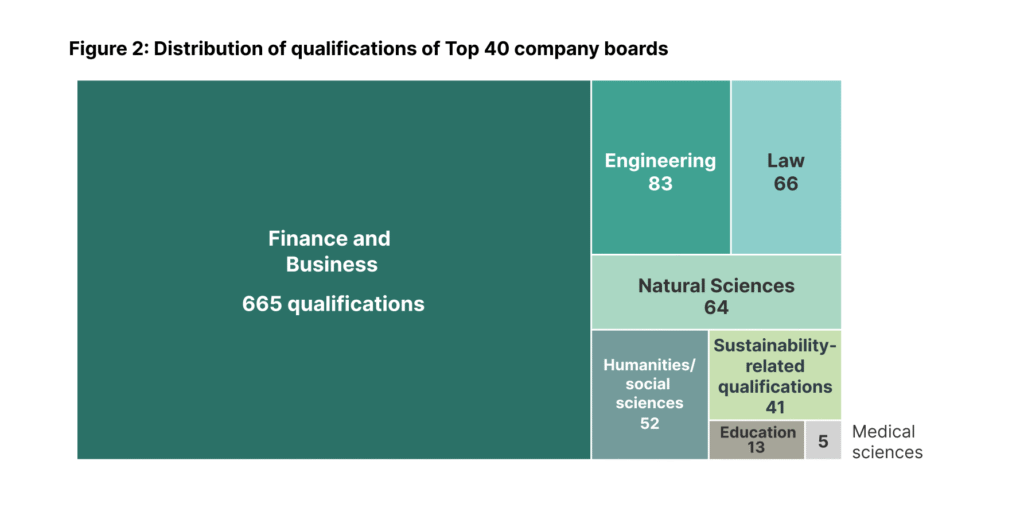

However, many companies claim that their boards contain sustainability expertise, without specifying what this expertise is or who holds it. Just Share’s assessment of expertise based on formal qualifications held by all Top 40 directors, finds that of the 989 qualifications at diploma level or higher, just 41 (4%) were sustainability-related qualifications. The vast majority of directors’ qualifications are in finance and business (67%), followed by engineering at 8% and law at 7%. Importantly, being sustainability-competent cannot derive only from having periodic access to consultants, sustainability advisors and in-house staff, nor can it be incentivised or induced only through mechanisms such as establishing a committee with an appropriate mandate, providing for a regular ‘sustainability report’, or setting executive pay benchmarks that include sustainability performance. Such measures are important, but they undervalue the need to ensure that sustainability traverses all aspects of a company’s performance.

Importantly, being sustainability-competent cannot derive only from having periodic access to consultants, sustainability advisors and in-house staff, nor can it be incentivised or induced only through mechanisms such as establishing a committee with an appropriate mandate, providing for a regular ‘sustainability report’, or setting executive pay benchmarks that include sustainability performance. Such measures are important, but they undervalue the need to ensure that sustainability traverses all aspects of a company’s performance.

To meaningfully and continuously integrate sustainability into all its strategic deliberations and decision-making, hold executives accountable for integration of sustainability considerations, set realistic but ambitious targets, and engage effectively with all stakeholders in a complex landscape, boards must include directors who themselves possess relevant expertise.

The briefing also finds that even on those boards which do contain directors with sustainability-related qualifications, these directors do not always sit on the boards’ social and ethics committees, where their expertise is highly relevant.

Just Share recommends:

- That corporate boards do more to ensure that they are giving sufficient weight to sustainability issues by appointing more directors with formal sustainability-related qualifications.

- That those directors who do possess sustainability-related qualifications should also sit on the boards’ social and ethics committees.

- That companies should significantly improve their disclosure of claimed sustainability expertise for directors who lack a formal qualification in this area, so that stakeholders can form a better picture of overall board sustainability capacity.