Wage inequality

In 2018, the World Bank found that inequality had deepened in South Africa since the start of democracy, and ranked the country as one of the most unequal on earth.

Globally, there is overwhelming evidence that unequal societies are more violent, have less stable and slower growing economies, poorer levels of education, and higher levels of mental and physical illness and infant mortality. The more unequal a society, the less likely are its citizens to trust each other and to participate in public and communal life.

Research from the OECD [fn1], the IMF [fn2] and others shows that excessive inequality is bad for growth: it can create political and social instability, which deters investment, and social divisions fuelled by inequality make it harder for governments to find the consensus necessary to tackle social and economic crises.

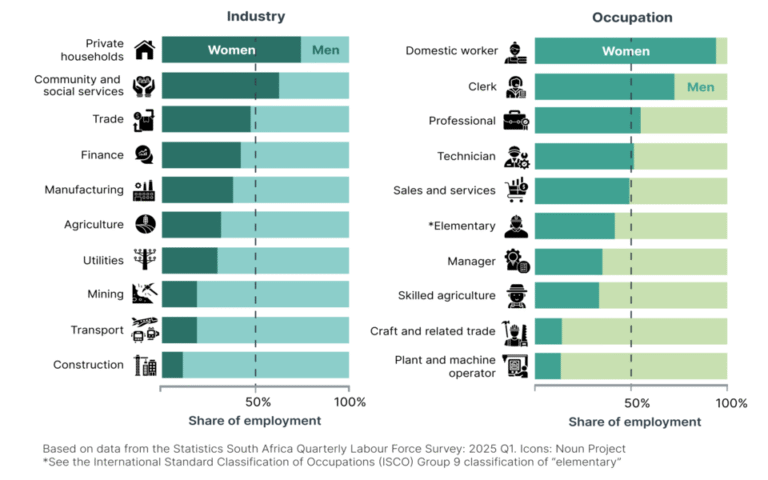

In South Africa, racial, gender and wealth inequality characterise every aspect of our society. Wage inequality and economic insecurity are particular forms of inequality that have very deep historical roots in South Africa and, arguably, the most drastic economic and social repercussions.

Vertical wage gap

The King IV Report on Corporate Governance is clear that “[t]he remuneration of executive management should be fair and responsible in the context of overall employee remuneration. It should be disclosed how this has been addressed. This acknowledges the need to address the gap between the remuneration of executives and those at the lower end of the pay scale”. However, there is no publicly available evidence that this recommendation has been adopted by SA’s listed companies.

In December 1999, Section 27 of the Employment Equity Act (EEA) came into effect. Section 27 of the EEA is a robust and progressive provision, even by international standards, and is specifically aimed at addressing the vertical wage gap in South Africa (i.e. the difference in pay between the highest and lowest paid employees in a company).

In terms of section 27, employers have to submit information annually to the Employment Conditions Commission (ECC, now the National Minimum Wage Commission) via the “EEA4” form, or income differential statement. This includes information about wage gaps within their organisations.

The ECC was supposed to use this information as a foundation to “research and investigate norms and benchmarks for proportionate income differentials and advise the Minister on appropriate measures for reducing disproportional differentials” [fn3]. Twenty-one years later, there does not appear to have been any implementation of this requirement, and this crucial information provided by thousands of employers over two decades has seldom seen the light of day.

In August 2019, the Department of Employment and Labour amended the old EEA4 form to require additional information. Employers must now disclose information about the pay of the employee with the highest and lowest total remuneration in each occupational level in a company, broken down by race and gender. Employers must also provide information about average and median remuneration and remuneration gaps, give reasons for income differentials, and indicate whether there is any policy in place to address and close the vertical wage gap.

The deadline for the first annual submission of these new forms was 15 January 2020. In 2020, Just Share will engage with the National Minimum Wage Commission around the introduction of norms and benchmarks on proportionate income differentials. We will also work collaboratively with responsible investors to drive transparency and action by listed companies in relation to this core pillar of inequality.

Diversity and transformation

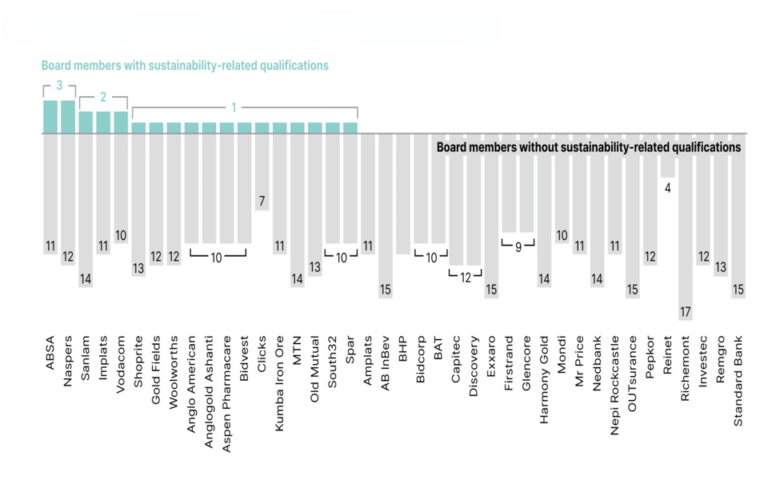

The need for diversity and transformation in our corporate sector is a self-evident social imperative, but board diversity is also widely acknowledged to be good for business. Even Goldman Sachs has recently announced that it will not take any company public unless it has at least one “diverse board member”. While there has been some progress on transformation at the highest levels of corporate South Africa, it has been very slow. African, Coloured and Indian people, and women, remain under-represented on the boards and senior management teams of listed South African companies.

Strangely, given the importance of this issue in this country, regulatory scrutiny is minimal. The JSE only introduced diversity-related requirements into its Listings Requirements in 2017 and 2018. These requirements are not particularly demanding: companies with a primary listing on the JSE must simply have policies in place on the gender and racial diversity of their boards, and set and report on voluntary targets. But the JSE has done little to date to ensure that even these requirements are being met.

In 2019 the JSE floated a draft amendment that would have introduced a non-binding shareholder advisory vote on board diversity, but this was dropped after the public comment process.

In 2020, Just Share will engage with the JSE to encourage it to ramp up its role in facilitating diversity and transformation, by at the very least improving its monitoring and enforcement of its own requirements for board diversity.

Similarly, we will be looking to SA’s responsible investors to push companies to do better on this issue, not only as a matter of compliance but also because of its benefits for the economy.

Just Share’s outlook for 2020 Part 1: Shareholder activism and the climate crisis

- Organisation for Economic Co-operation and Development

- International Monetary Fund

- Section 27(4) of the EEA