The average lowest paid worker in the wholesale and retail sector would need to work for 21 months to earn what an average CEO in this sector earns in one day.

New research by Just Share looks at ten JSE-listed companies in the wholesale and retail space, based on analysis of these companies’ most recent public disclosures. The research highlights significant pay gaps and poor levels of diversity at the board and management level.

Shoprite Holdings, Pick n Pay, Pepkor Holdings, The Foschini Group, Woolworths, Mr Price Group, Dis-Chem, Clicks Group, Truworths International, and Spar Group together employ 389,766 full-time employees and account for R833.7 billion in yearly revenue. Overall, the wholesale and retail sector is the second-largest employer in South Africa after government, employing about 17% of the workforce.

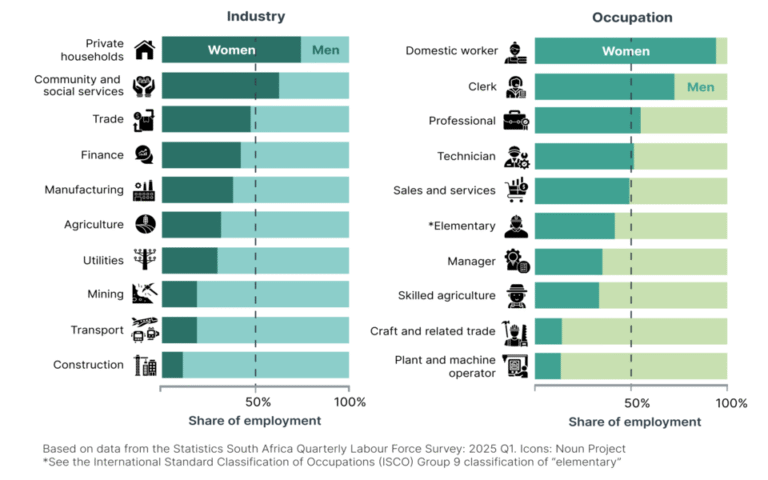

The sector’s performance on gender and racial diversity at board and top management levels is mixed, with disappointingly low targets set by several of the companies analysed here.

Vertical pay gaps

The average unweighted ratio between total CEO remuneration and total lowest earner’s remuneration is 597, and the highest ratio is 1 308 (Woolworths). In other words, CEOs in this sector earn on average 597 times the wages of the lowest paid workers.

Woolworths’ internal minimum wage of R93,600 per annum is significantly higher than its competitors, and 57% higher than the 2023 sectoral determination figure of R59,483 per annum. This is offset by the largest CEO remuneration package at R 122 468 000. At its 2023 annual general meeting Woolworths struggled to respond to a shareholder question as to how it considers the CEO’s single-figure remuneration to be “fair and responsible”.

Just Share’s senior inequality analyst Kwanele Ngogela says: “While the sector undoubtedly plays an important role in providing employment to low- and semi-skilled workers, it is nevertheless crucial to also recognise the contribution of the extreme vertical wage gaps which characterise these companies to the country’s overall high levels of inequality.”

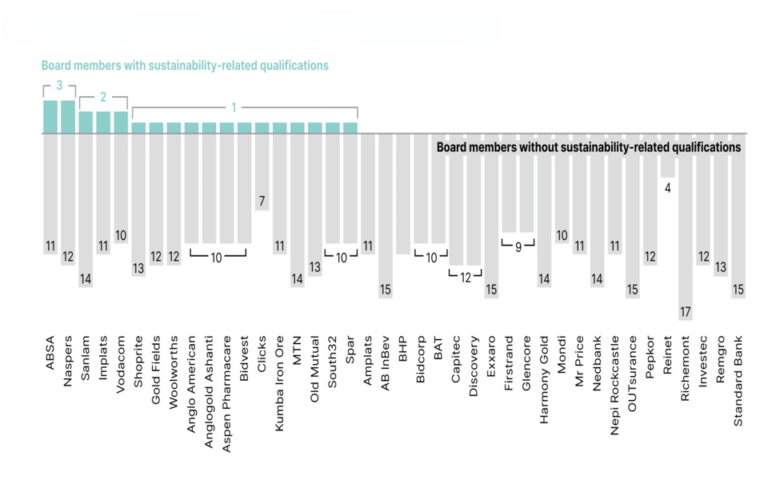

Board representation

All companies listed on the JSE are required by law to promote gender and race diversity at board level. Unfortunately, many companies still fall short.

Clicks stands out as the only company where black individuals make up the majority (60%) of the board, followed by Spar with 50% black representation. The wide range in target ambition – from Truworths’ very low 30% ACI representation target to the still-modest highest target of 50% – is hard to understand. The targets in the lower range suggest a particularly lacklustre commitment to transformation.

Women make up 46% of the economically active population (EAP), and Pepkor is the only company where the board is representative of the EAP in terms of gender. Clicks and Spar have both achieved 40% female representation. Shoprite, Woolworths and Mr Price have higher targets (40%), although they have not met their goals.

Management representation

The Employment Equity Act 55 of 1998 (EEA) requires employers to implement affirmative action measures to achieve diversity and equity in their workforce. The Act requires companies to disclose the breakdown of race and gender representation for top and senior management, although several companies did not provide this information.

Diversity and transformation in top and senior management is crucial for succession planning to ensure that the next cohort of leaders of these companies is more representative than current leadership of the country’s diversity.

The current EEA legislation does not impose transformation targets, instead relying on companies to develop their employment equity plans and set diversity targets and timelines to achieve reasonable progress towards employment equity. However, this approach has failed to drive meaningful change, especially in key strategic and management roles in this sector.

Poor levels of representation of women and black people in top management roles, which are consistently lower than at the board level, suggests that equitable representation in the workplace may not be a primary focus in these companies. The Foschini Group is the exception when it comes to female representation.

Incomplete data and new legislation

The disclosure of employment equity data is still sporadic, inconsistent, and incomparable. Some companies ignore legislative guidelines on how this data should be reported. Pepkor, for example, does not report employment equity data. Dis-Chem, Pick n Pay, and Woolworths report only aggregated figures, and several companies do not disclose female representation in top management at all.

The Companies Amendment Act 16 of 2024 which has recently been signed into law by President Ramaphosa and is likely to be proclaimed soon, will make vertical pay gap disclosure mandatory for public and state-owned companies, requiring them to disclose:

- the total remuneration received by each director and prescribed officer in the company;

- the total remuneration of the employees with the highest and lowest total remuneration;

- the average total remuneration of all employees, median remuneration of all employees; and the remuneration gap reflecting the ratio between the total remuneration of the top five per cent highest paid employees and the total remuneration of the bottom five per cent lowest paid employees.

But the Amendment Act 2024 does not include requirements for gender pay gap disclosure, despite calls for it to do so over several years of public participation processes. This is a missed opportunity which should be prioritised in future legislation.