One of the stranger aspects of South Africa’s multi-trillion Rand investment industry is that so much of this powerful system rests on an insecure base: the employee-elected pension fund trustee. While many individual trustees are dedicated to improving the retirement prospects of their work colleagues, as a group, these trustees are the poorest resourced of a long chain of otherwise extremely well-resourced players. Also, many of them know little about the dense world of investment.

The employee-elected trustee is the very first link in a chain that stretches from the work place, through several well-remunerated levels of advisors, to an investment in a company that may go on to thrive, or burn out. The chain has been made even longer, more opaque and less accountable with the creation of umbrella funds.

In terms of the law, the buck stops with the trustee. His or her fiduciary duty to the fund is exactly the same as a director’s is to a company, which is a daunting thought given the personal liability it implies, and rather ironic given that the employee trustee is the only entity in the chain that receives no payment. While there are occasional reports of liability charges against trustees, they are few and far between – even more rare than the director of a public company being chased for failing his or her fiduciary duties.

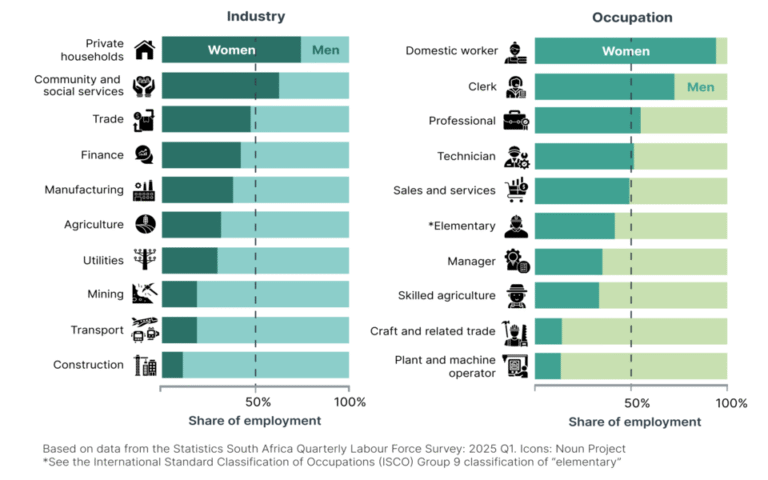

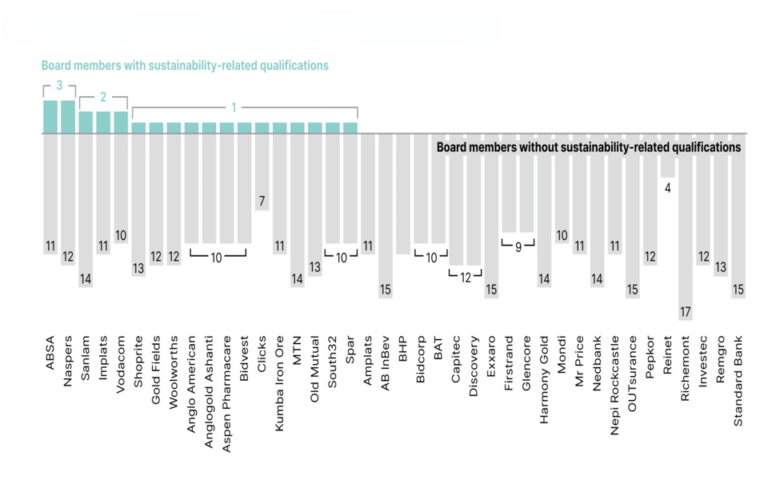

In terms of Regulation 28 of the Pension Funds Act trustees are obliged, in their investment decision-making, to give appropriate consideration to factors of an environmental, social and governance (ESG) character which may affect the sustainable long-term performance of a fund’s assets. They are also required to have an investment policy statement which clearly sets out their approach to ESG issues. This assumes that the unremunerated trustee will have knowledge of ESG matters, knowledge that is frequently absent even amongst the well-paid analysts at the other end of the chain. Free ESG training for trustees is available, but employee trustees are often not permitted to take time off work to attend it.

To side-step the threat of charges of negligence, pension funds use asset consultants to advise on the choice of asset managers to manage their investments. While this lets them hand over management of the funds, the trustees remain responsible for the fund and its actions. In too many cases, trustees fail in their fiduciary duties by not maintaining oversight of their asset managers.

There are often potentially serious conflicts of interest inherent in the group structures of financial entities. For example, an asset management firm employing analysts to scrutinise the ESG risks of investee companies might be part of a group in which another entity has close business links with the management of those investee companies. Although there should be systems in place to manage these potential conflicts, in reality the links can easily compromise objective analysis. In a rare public reveal of such a conflict, Investec, one of the largest asset managers in the country, issued a public apology in mid-2018 to the enormously well-remunerated CEO of Tongaat, Peter Staude, after one of its analysts suggested in a report that the CEO should resign because of the company’s “appalling” financial results. Investec’s spokesperson issued a swift assurance that this was “not the view of the Investec Group”, and that “to the extent to which [the report] has caused embarrassment to Mr Peter Staude, with whom we have had a long and fruitful relationship, we apologise.”

Every link in the chain of advisers is expert at explaining, in the aftermath of a corporate implosion, why it would be unreasonable to expect them to have foreseen what happened. This is despite many of them marketing their services as including superior analytical capabilities. Coronation Fund Managers issued a five-page letter to its clients in January 2018 explaining why it had not seen the Steinhoff catastrophe approaching. And yet Coronation claims, in its Transparency Report to the UN-backed Principles for Responsible Investment, that it employs “70 dedicated responsible investment staff” and that “we spend large amounts of time studying the corporate governance of the companies we invest in”.

Similarly, every link in the investment chain is expert in explaining why responsible investment practices have not been implemented as required. The asset managers blame the pension funds and their trustees for not setting the necessary mandates, while the trustees blame the asset consultants for failing to advise them appropriately.

Pension fund trustees have perhaps not fully understood the powerful position they hold in ensuring that responsible investment in South Africa generates meaningful social and economic outcomes, while ensuring environmental sustainability. It is time for them to take their fiduciary duties more seriously, and in doing so, to contribute to a fairer society and a more inclusive economy.