French NGO Reclaim Finance, in partnership with 26 other NGOs [fn1], has today released an online tool to identify, assess and compare the policies adopted by financial institutions worldwide to restrict or end financial services to the coal sector [fn2].

The Coal Policy Tool rates the coal financing policies of 214 financial institutions on a consistent and transparent scoring grid built on five key criteria. It also identifies the largest banks, re/insurers, asset owners and asset managers which have not yet taken any steps to limit coal financing [fn3].

The Coal Policy Tool is the world’s most comprehensive database assessing the quality of existing coal financing policies against the Paris Agreement goal of keeping global warming below 1.5 degrees Celsius above pre-industrial levels. The tool, which will be updated in real-time, spans 30 countries, including South Africa.

The number of coal financing policies has been growing fast since the adoption of the Paris Agreement in 2015. However, according to the Coal Policy Tool, only 16 financial institutions globally, including AXA, Crédit Agricole/Amundi, Crédit Mutuel and UniCredit have a robust coal phase-out policy [fn4].

Most coal policies are too weak to even prevent growth in the coal sector, let alone phase out coal financing.

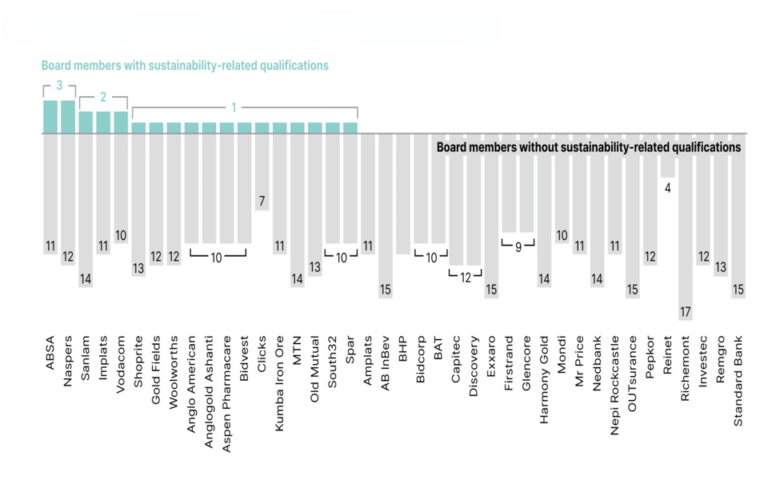

South African banks Absa, Investec, Nedbank and Standard Bank each score zero in four out of the five categories assessed by the Coal Policy Tool. FirstRand scores zero in all five categories.

In the first category, which assesses whether policies have exclusions for coal power, coal mining and coal infrastructure projects, the highest score is Nedbank, with 5/10. Nedbank is the only South African bank which has completely excluded the financing of new coal-fired power plants.

In the first category Absa and Standard Bank score 2/10, and Investec scores 1/10.

“The tool goes beyond identifying and comparing policies and enabling clients, media, financial institutions, and other stakeholders to navigate the coal policy jungle easily. Above all, it aims to ensure high-quality coal policies that effectively contribute to preventing climate chaos,” says Lucie Pinson, Founder and Executive Director of Reclaim Finance.

Pinson adds: “It is not enough to adopt a policy, what we need are good coal policies. French financial institutions were the first global players that adopted policies on coal, but these policies had to be amended many times before they became sufficiently robust to support a coal exit. We cannot afford to continue delaying real action. Addressing oil and gas is increasingly pressing; financial institutions need to now urgently progress to the level of the highest quality coal policies identified by our tool.”

What is a good coal finance policy?

To align with the goals of the Paris Agreement, financial institutions’ coal policies must:

- cover the entire value chain, from mining to power through infrastructure;

- tackle all financial services, including corporate and project financing, underwriting, and passive fund management; and

- combine exclusion criteria and engagement not only to stop the expansion of the coal sector but also to support its responsible phase-out.

Stopping the development of new coal projects is essential if we are to stand a chance of keeping global temperature increases below the 1.5ºC target set by Paris Climate Agreement. Financial institutions must rule out all financial services to new coal projects, as well as all general corporate support to companies with coal expansion plans.

Existing coal assets must be progressively phased out, and not sold. This is a major risk in South Africa where global players are increasingly offloading their coal operations, as well as massive associated environmental liabilities and climate risk, onto smaller companies.

Financial institutions must commit to bringing their coal exposure to zero by 2030 in Europe and OECD countries and by 2040 in other countries. Achieving these goals requires the immediate exclusion of financing for companies highly exposed to coal – either because a large share of their activities is based on coal or because the sheer size of their coal activities is significant [fn5].

Most banks and insurers still support new coal projects

216 top financial institutions [fn3] have no policy on coal, and most banks and insurers allow direct financing or insurance coverage for new coal projects. This is the case for the UK insurance market Lloyd’s, the US insurers AIG and Liberty Mutual, the Chinese bank ICBC and the Polish insurer PZU, which do not exclude any new coal projects. Many other financial institutions in all parts of the world only exclude some of the worst projects. This is most common amongst banks in the US, Asia and South Africa.

Existing policies are insufficient to mitigate the impacts of the coal sector

50 banks and insurers analysed in the tool still do not exclude any coal companies from financial services, but only exclude some financial services at the project level. Even where coal companies are excluded, most of these exclusions are based only on the relative share of coal in their activities. As revealed by the Global Coal Exit List, a database maintained by the NGO Urgewald, this approach leads to policies that let some of the biggest coal producers or coal plant developers off the hook.

Most financial institutions are failing to address the urgent need to exit coal

The Coal Policy Tool shows that coal financing policies do very little to support the closure of existing coal assets within a timeframe that aligns with the goals of the Paris Agreement. Only a very small number of financial institutions have started (a) to commit to reducing their exposure to the coal sector to close to zero by 2030 in Europe and OECD countries and by 2040 in other countries and (b) to adopt a strategy to meet this target. Some French financial groups are now requiring that their remaining clients adopt a coal phase-out plan by the end of 2021 and have pledged to drop clients who are unable to prove their ability to exit coal in a timely and orderly manner.

- The Coal Policy Tool is launched in partnership with the following NGOs: 350; BankTrack; Both Ends; Centre for Financial Accountability; CEED – Center for Energy, Ecology, and Development; CLEAN; Ecologistas en Acción ; Fossil Free California; Foundation “Development YES – Open-Pit Mines NO”; Friends of the Earth US; Global Witness; Instituto Internacional de Derecho y Medio Ambiente; Jacses; Just Share; Kiko Network ; Les Amis de la Terre France; Maan ystävät – Friends of the Earth Finland; Rainforest Action Network; Re:Common; RESET; ShareAction; Solutions For Our Climate; Sierra Club; Urgewald. The NGO campaigns Europe Beyond Coal; Insure Our Future and BlackRock’s Big Problem also endorse the tool.

- The Coal Policy Tool is accessible at https://coalpolicytool.org

- The Coal Policy Tool covers:

- The top 20 banks/asset owners/asset managers in global rankings (Standard & Poor’s for banks, Willis Towers Watson plc for asset owners and asset managers), and insurers covered in the 2019 Scorecard on Insurance (Insure Our Future), whether they have a coal policy, or not;

- All financial institutions in the top 100 of those rankings, which were assessed systematically, for which Reclaim Finance could find a coal policy;

- Some other smaller financial institutions above a minimum threshold of 10 billion USD of assets for which Reclaim Finance could find a coal policy through research and from partners worldwide, without conducting a systematic assessment, and

- Some other financial institutions added at the request of our partners.

More information on this methodology is available on this here. The Coal Policy Tool rates the policies of 214 financial institutions, accounting for duplicates as insurers are graded both for their insurance as well as their investment policies.

Reclaim Finance found that 216 top financial institutions have no coal policies. This number incorporates to financial institutions in the top 100 global rankings mentioned above of banks (Standard & Poor’s), asset owners and asset managers (Willis Towers Watson plc), and insurers in the 2019 Scorecard on Insurance (Insure Our Future) with duplicates removed. It is important to note that only the largest financial institutions with no coal policy were integrated in the Coal Policy Tool.

- The 16 financial institutions with a robust coal phase-out policy are part of the following 10 financial groups: the top players AXA, Crédit Agricole/Amundi, Crédit Mutuel, and UniCredit along with 6 other French financial groups: AG2R La Mondiale, CNP Assurances, La Banque Postale Asset Management, MACIF, OFI Asset Management and SCOR in its capacity as an investor (the reinsurer SCOR has a minimal coal policy that only ends facultative coverage at project level).

- Reclaim Finance and its partners call on financial institutions to exclude all companies generating more than 20% of their revenue or 20% of their power production from coal as well as companies that produce more than 10 million tons of coal a year or have more than 5 GW of coal power production capacity. More information is available here.

Media interviews

Lucie Pinson, Founder and Director of Reclaim Finance, lucie@reclaimfinance.org, +33 679543715.

About Reclaim Finance

Reclaim Finance is a France-based NGO founded in 2020. Our vision is a financial system that supports the transition to sustainable societies that preserve ecosystems and satisfy people’s basic needs. In the context of the climate emergency and biodiversity losses, one of Reclaim Finance’s priorities is to accelerate the decarbonisation of financial flows. We speak out against the negative impacts caused by certain financial institutions and push for changes by pressuring these institutions and requiring political decision-makers change existing laws and practices.