This Just Share article was written for & distributed by Anchor Stockbrokers.

There is a popular meme in the world of environmental, social and governance (ESG) professionals, depicting four examples of “the fastest things on earth”, ranked in order of increasing speed: a cheetah, an aeroplane, the speed of light, and “people becoming “specialists” in ESG”. It’s popular because it is frustrating for those who have spent years or decades focusing on sustainability to see others with little to no relevant experience suddenly appearing in new roles with titles like “Chief Sustainability Officer” and “Head of ESG”.

Of course, it is great to see growth in professional roles which focus on sustainability and prioritise the broader societal impacts of the corporate sector. And there is no doubt that it is difficult to find people to fill these roles: there are very few professionals with a long track record of ESG-related competencies who also have deep experience in management and governance of large companies. But if we try to address the demand for more responsible corporate behaviour by assigning new titles to old roles and traditional mindsets, we will enter an era of “competence washing” which will seriously undermine what chance we have of achieving the UN Sustainable Development Goals.

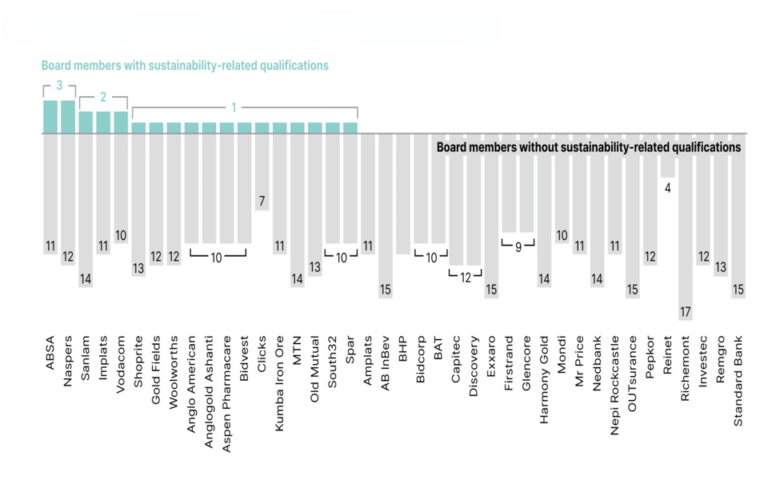

Just Share has been interested to note that an increasing number of JSE-listed companies are assigning apparently new sustainability-related credentials to longstanding board members in their annual reports. When we look at the professional backgrounds of those board members, it is often difficult to see what the source of this expertise is. In our engagement with companies on the issue, the most common response is that this expertise stems from the fact that the board members in question sit on the social and ethics committees, or other sustainability-related committees, of the boards of other listed companies.

Sustainability encompasses a broad range of interconnected risks and opportunities facing businesses today, from climate change to biodiversity loss, deforestation to water scarcity, human rights to inequality, diversity and transformation. Of course, exposure to one or more of these issues as part of the governing body of one company will help in recognising and addressing them at another company. But on its own, this isn’t good enough: if investors were told that a director’s financial or legal or business expertise stemmed solely from his or her experience on another board, rather than from a professional qualification or track record, they would be outraged.

It is also important that “relevant ESG experience” is not interpreted to mean “experience in the same sector”: for example, a coal mining company with board members who are executives or non-executive directors at other coal mining companies cannot claim on this basis alone that those directors have “climate change expertise”. Expertise in this context means skills and experience in tackling the problem, not experience in contributing to it.

While “upskilling” existing board members in key ESG-related areas is necessary and important, it is not sufficient to drive the urgent and dramatic change in thinking that is required to address the multiple crises facing people and planet. It is essential for boards to start looking outside of their traditional networks to recruit members who have real sustainability-related qualifications, experience and expertise, that is at the very least relevant to the most material sustainability risks facing that company. In the process, they might be pleasantly surprised by the other advantages that a more diverse skillset and range of experience can bring.

In the meantime, investors should be asking management to explain how they define and measure what constitutes “sustainability expertise”, and to demonstrate how and why they have determined that a particular board member (or any senior executive, for that matter) qualifies as having it.