This article by Tracey Davies first appeared in the Business Day on 15 July 2019

South Africa has experienced a steady stream of corporate governance failures in recent years, with each new scandal further exposing the fiction that corporate leaders can be trusted to “self-regulate”. In the wake of these events, there was much posturing by regulators about plans to get tough on adherence to corporate governance rules. But three recent sets of regulatory amendments reveal how toothless these threats were, and how ineffective our country’s legislators are when it comes to reining in big business.

In 2018 the following pieces of proposed regulatory and legislative amendments were released for public comment:

- Draft Directive on sustainability reporting and disclosure requirements (Financial Services Board, now the Financial Sector Conduct Authority, March 2018);

- Consultation Paper on possible regulatory responses to recent events surrounding listed issuers and trading in their shares (JSE, September 2018);

- Companies Amendment Bill, 2018 (department of trade & industry, September 2018).

These documents, in particular the first two, appeared to indicate willingness on the part of regulators to strengthen some of the weaker areas of corporate governance and responsible investment oversight. The Draft Directive and the Consultation Paper processes are now complete and the outcomes backtrack significantly from any attempt at bold regulatory reform.

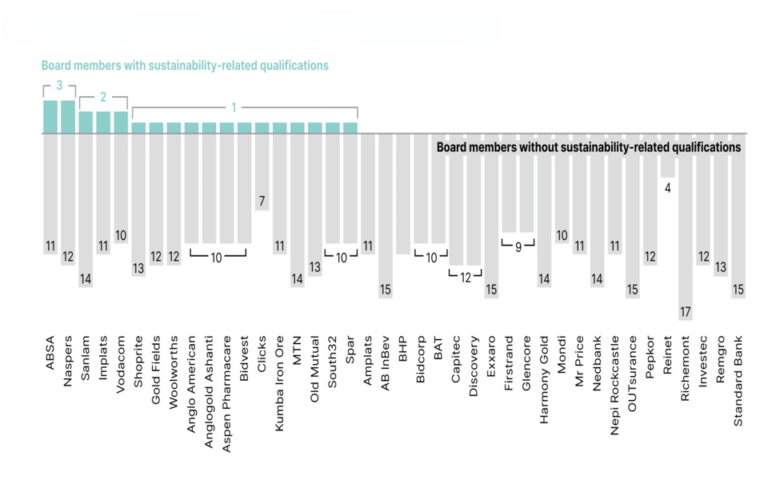

The long-awaited Draft Directive aimed to clarify the obligation on pension fund trustees to incorporate environmental, social and governance (ESG) factors into their investment decision-making, which they are required to do by Regulation 28 of the Pension Funds Act. The need for clarification arose because, despite the promulgation of regulation 28 in 2011, pension fund trustees did not appear to be acting robustly or transparently on ESG integration. There was also very little oversight or transparency of the responsible investment policies required by Regulation 28.

The Draft Directive set out the matters to be covered by a pension fund’s investment policy statement, including an explanation of “how its investment approach ensures the sustainable long-term performance of its assets”, as well as a number of transparency and reporting requirements. If the Directive had been finalised, pension funds would have been required to implement these requirements by no later than 12 months after its effective date.

In June 2019, more than a year since the Draft Directive was published, and instead of a final directive, the FSCA released only a “guidance notice on the sustainability of investments and assets”.

This means there are no legal obligations on pension funds to improve their implementation of regulation 28, or to become more transparent. The FSCA merely “encourages and advises” the pension funds industry, “in the interest of transparency, accountability and the fair treatment of its members, to apply the principles set out in [the] guidance notice dealing with disclosures and reporting”.

In practice this will mean little will change: those funds that were already implementing Regulation 28 robustly will continue to do so, and the vast majority that are not are no more incentivised to improve than they were before the issuance of the Draft Directive.

In response to queries from the UK-based publication Responsible Investor, an FSCA spokesperson said the FSCA “is no longer ‘empowered’ to issue [directives] following changes to the Pension Funds Act”. However, the FSCA could instead have issued a conduct standard in terms of section 106 of the Financial Sector Regulation Act, which would have a similar effect to a Pension Funds Act Directive.

The JSE’s consultation paper was developed “with the aim of obtaining public input on possible improvements to its regulatory approach to new and existing listings on the JSE”. It proposed, inter alia, the following changes to the JSE Listings Requirements:

- That a prelisting statement should disclose the particular laws relevant to an applicant issuer’s main industry of operation (for example, mining), and that the board of directors make a “positive statement regarding compliance with the above legislation” in the prelisting statement.

- Mandatory training for members of the audit committee and company secretaries on their responsibilities pursuant to the Companies Act and the JSE Listings Requirements.

- A non-binding advisory vote on corporate governance to address the “need for enhanced focus and accountability in respect of corporate governance”.

The amended listings requirements do not incorporate the requirement to make a positive statement regarding compliance with laws relevant to the issuer’s main industry of operation. Despite a plethora of reports in recent years by civil society and academia detailing corporate legal non-compliance, particularly with mining and environmental laws, the JSE was persuaded by industry submissions that “it may not be practical to address compliance with each and every law”.

The amended Listings Requirements do not require that mandatory training be undertaken by the audit committee and company secretaries, broadly because the JSE was persuaded by submissions that this training would be too burdensome. The JSE also decided not to proceed with the proposal for a non-binding advisory vote on corporate governance.

Let’s be clear: none of the proposed amendments were ground-breaking to begin with, and so the fact that most of those with some potential to improve the system have been abandoned or weakened is particularly disappointing. But there are also a host of other golden opportunities regulators would be expected to take up if they were really serious about improving accountability in the private sector. Three of the most obvious missed opportunities include:

Binding vote on executive remuneration:

South African listed companies are currently required to table only a non-binding advisory shareholder vote on executive remuneration. If more than 25% of shareholders vote against remuneration, the company is required simply to “engage” with those shareholders.

South Africa is one of the world’s most unequal countries, but relative pay for JSE-listed company executives is among the highest in the world. The amendment of the Companies Act to require a binding vote on executive remuneration would have been a clear signal from the DTI that the government is serious about tackling wage inequality. Such a requirement could be tailored to suit local conditions, as it has been in the UK, France and Australia. But the 2018 Companies Amendment Bill merely proposes the insertion of a section requiring the preparation of a three-part “directors’ remuneration report”, which must only be “presented to shareholders at the annual general meeting”.

Disclosure of remuneration gap:

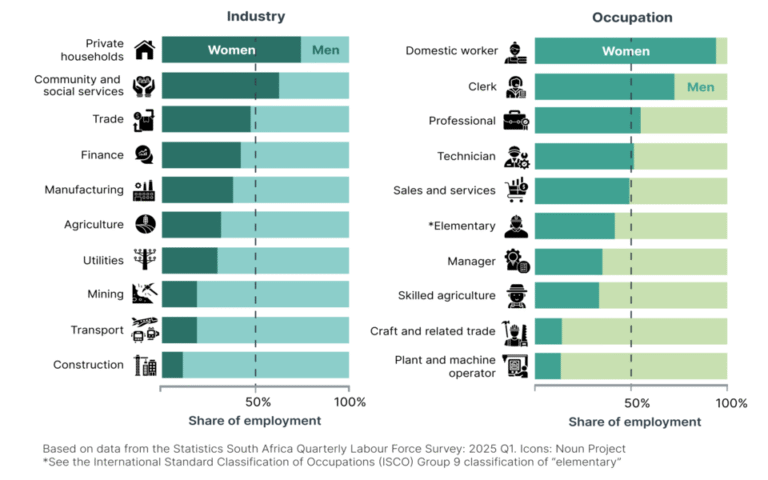

Despite the fact that disclosure on the remuneration gap between men and women and information about the wages of the lowest-paid workers at listed companies is recommended by King IV, and was supported by business at the October 2018 jobs summit, neither the JSE nor the DTI or the Department of Labour have proposed any regulatory changes to implement this disclosure.

Climate crisis:

Climate disruption is now manifesting itself daily, and financial and corporate regulators globally are clear on the role that business must play in tackling this crisis. It would be a simple yet profound step for the FSCA to require, or even recommend, that pension funds incorporate a climate-change position statement in their investment policy statements, and for the JSE to recommend that all its members should report in terms of the recommendations of the task force on climate-related financial disclosures. Just Share and others have repeatedly called for regulators to take these simple steps, but have received no response.

It is impossible to tell whether this regulatory timidity is the result of corporate lobbying, political compromise, capacity constraints or all of the above. But it is hugely disappointing that, even in the light of all that has transpired in the past few years, the people in charge of holding big business to account in South Africa seem unwilling to take the bold steps that might actually result in meaningful change.